News

Cyprus Property Market Q1 2025: A Nationwide Surge in Real Estate Transactions

2 May 2025

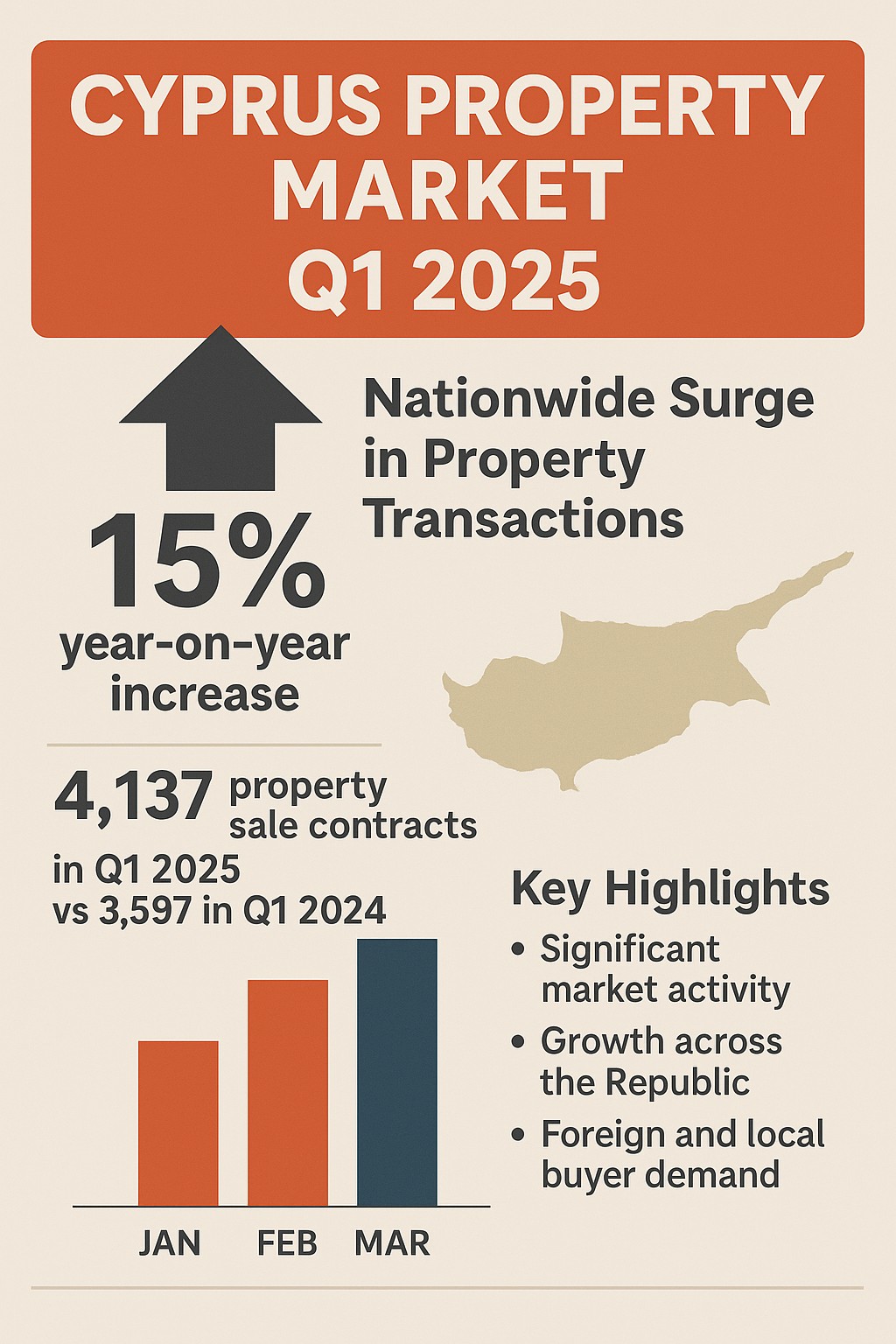

The Cyprus property market Q1 2025 sees a 15% year-on-year surge with 4,137 sale contracts filed. Explore trends, stats, and investment insights for Cyprus real estate in early 2025.

Introduction: Unpacking the Q1 2025 Boom

The Cyprus property market Q1 2025has opened the year on an impressive note, registering a 15% increase in the number of sale contracts filed compared to the same period in 2024. With 4,137 transactions recorded in the first quarter—up from 3,597 the previous year—this surge signals renewed confidence among local and foreign investors alike. But what’s fueling this upswing, and what does it mean for the remainder of the year?

Q1 2025 at a Glance: Key Statistics

The Department of Lands and Surveys has reported that:

- 4,137 property sale contracts were submitted in Q1 2025

- This marks a 15% year-on-year growth

- Monthly breakdown:

- January: 1,202

- February: 1,348

- March: 1,587

This rising trend reflects a broad-based recovery and heightened demand, particularly in the residential and luxury segments.

Regional Performance Across Cyprus

Each region played a pivotal role in the nationwide surge, though some stood out more than others:

- Limassol: Continued dominance with the highest transaction values

- Paphos: Surged with international buyers, especially Brits and Germans

- Nicosia: Saw growth in urban apartments and commercial properties

- Larnaca: Gained traction due to airport proximity and affordability

- Famagusta: Smaller base but noticeable percentage growth in coastal properties

The surge was broadly distributed, showcasing investor interest across the island.

What’s Driving the Surge in Sales Contracts?

Several powerful factors contributed to the increase in Q1 sales activity:

- Post-pandemic momentum carried forward from 2024

- Improved flight connectivity with key EU and Middle Eastern hubs

- Renewed interest in second homes and rental investments

- Eurozone economic recovery, boosting investor confidence

Real estate remains a stable and inflation-resilient asset, especially attractive in uncertain global markets.

Impact of Government Policies on Market Growth

The Cyprus government has actively supported the real estate sector with:

- First-time buyer subsidies

- Reduced property transfer fees

- Digital infrastructure for property registration

- Continued support of the Permanent Residency by Investment scheme

These initiatives have streamlined transactions and lowered entry barriers, particularly for foreign investors and young families.

The Role of International Buyers in Q1 2025

Foreign buyers were instrumental in shaping the Q1 growth curve. Popular nationalities included:

- UK

- Germany

- Israel

- Lebanon

- Russia and Eastern Europe

Key preferences:

- Coastal areas like Paphos, Limassol, and Larnaca

- Residency-compliant properties valued over €300,000

- Investment-grade apartments, townhouses, and villas

This ongoing interest confirms Cyprus’s appeal as a low-tax, high-lifestyle EU destination.

Residential vs Commercial Sales Dynamics

The growth trend covered both major sectors:

- Residential Sales:

- Strongest in suburban and seafront areas

- Continued boom in apartment complexes and detached homes

- Commercial Sales:

- Demand from the tech and finance sectors

- Office expansions in Limassol and Nicosia

- Mixed-use developments gaining popularity

The dual rise in both sectors highlights comprehensive market strength.

Demand for Off-Plan and New Build Properties

Buyers are increasingly drawn to:

- Off-plan villas and apartments

- Eco-conscious housing with solar and smart tech

- Integrated developments offering gyms, pools, and coworking

Advantages include:

- Lower initial capital

- Customization options

- Capital gains upon project completion

Developers report that many off-plan launches were pre-booked within weeks.

Cyprus Property Types in Demand

The Q1 trend shows clear property preferences:

| Property Type | Buyer Segment | Trend |

| Luxury Villas | HNWIs, retirees | Very High |

| Urban Apartments | Expats, locals | High |

| Coastal Homes | Short-term investors | Surging |

| Rural Houses | Long-term settlers | Steady |

Apartments in gated communities and seaside townhouses led the charge.

Technology’s Role in Driving Real Estate Transactions

Digital transformation continues to fuel efficiency and accessibility:

- Online property platforms such as Bazaraki and Spitogatos increased visibility

- Virtual viewings and 360 tours for international buyers

- E-signatures and remote notary services streamline cross-border transactions

Cyprus is quickly catching up with global PropTech trends to support its booming market.

Comparing Q1 2025 with Previous Quarters and Years

| Year | Q1 Sale Contracts | Growth Rate |

| 2023 | 3,145 | — |

| 2024 | 3,597 | +14.3% |

| 2025 | 4,137 | +15.0% |

The data shows consistency in quarterly upward movement, signaling a sustainable trend rather than a spike.

Cyprus vs Other Mediterranean Property Markets

When compared with peers like Malta, Greece, and Spain:

- Lower entry costs than most EU nations

- Favorable tax regime and low property taxes

- Easier residency acquisition

- Less bureaucratic red tape

These elements keep Cyprus in the spotlight for savvy global investors.

Mortgage Market and Financing Trends

Cyprus banks are showing renewed lending appetite:

- Interest rates stabilizing after ECB hikes

- Up to 80% financing available for EU residents

- New homebuyer programs for citizens and residents

This access to financing fuels middle-class participation and boosts overall transaction volume.

Expert Insights on the Market Momentum

According to Andreas Savva, a top developer in Limassol:

“We’re experiencing strong forward bookings for summer 2025. Foreigners are buying not only for lifestyle but for capital preservation.”

Market analysts suggest that Cyprus is entering a 3-5 year growth cycle, especially for urban redevelopment and tourism-based housing.

Opportunities for Investors in 2025

Key opportunities this year include:

- Buy-to-let apartments in university towns

- Short-term rental villas near tourist beaches

- Commercial hubs near ports and tech parks

- Early-stage investments in redevelopment zones

Rental yields in hot zones like Paphos and Limassol range between 5.5% and 7.2% annually.

Legal Considerations for Buyers in Cyprus

Cyprus remains transparent and secure for investors:

- Foreigners can legally own freehold property

- Title deeds are mandatory for new sales

- Legal checks include land registry, zoning, and developer licenses

- Use of registered real estate agents is advised

Buyers should always consult a local lawyer to avoid hidden liabilities.

Challenges Facing the Property Market in Cyprus

Despite the positive trend, challenges exist:

- Urban congestion in major cities

- Delays in title issuance for older properties

- Rising construction material costs

- Short-term rental regulations under discussion

These issues require policy responses and urban planning reforms.

FAQs About the Cyprus Property Market Q1 2025

1. Is the Cyprus property market still affordable in 2025?

Yes, though prices are rising, many areas like Larnaca and rural Paphos remain cost-effective.

2. Can non-EU citizens buy property in Cyprus?

Absolutely. They can own property and apply for permanent residency if investing €300,000+.

3. What are the property taxes in Cyprus?

There is no inheritance tax, and transfer fees range from 3% to 8%. VAT is 5% for first homes.

4. Are short-term rentals legal in Cyprus?

Yes, but they must be registered with the Deputy Ministry of Tourism.

5. What documents do I need to buy a house in Cyprus?

Valid passport, proof of funds, and a property sales contract are essential.

6. Will the market continue to grow in 2025?

Experts forecast continued moderate growth, supported by international interest and infrastructure development.

Conclusion: A Promising Start to 2025 for Cyprus Real Estate

The Cyprus property market Q1 2025has delivered impressive results, marking a 15% rise in sales contractsand widespread buyer confidence. With foreign interest rising, policy support in place, and robust infrastructure upgrades, Cyprus stands on the cusp of a golden era for real estate investment.

Fox Real Estate Team is here to assist you locating the best possible cyprus property investment for your needs.